At Jones Hollow Realty Group, we understand that navigating the Long Island housing market can be both exciting and challenging, particularly given the recent fluctuations and unique trends. While no one can predict the market’s future with absolute certainty, we are committed to staying informed and providing you with the most up-to-date insights.

At Jones Hollow Realty Group, we understand that navigating the Long Island housing market can be both exciting and challenging, particularly given the recent fluctuations and unique trends. While no one can predict the market’s future with absolute certainty, we are committed to staying informed and providing you with the most up-to-date insights.

Our team of dedicated professionals closely monitors market data and expert opinions, allowing us to offer educated estimates on what to expect when buying or selling a home on Long Island. However, it’s essential to remember that housing market forecasts should serve as a guide rather than the sole determinant of your real estate decisions. Your personal situation, financial circumstances, and individual goals should always take precedence.

At Jones Hollow Realty Group, we are here to support you through every step of your Long Island real estate journey. Let our expertise and commitment to excellence be your guide as you navigate the dynamic and ever-changing landscape of the local housing market.

Housing Market Prices and Sales

Let’s be clear: 2023 is a far cry from the frenzy of 2021. The days of homes receiving multiple offers and selling for significantly above the asking price within mere hours of listing have largely subsided. However, the Long Island market remains robust and continues to thrive. The current market conditions offer a more balanced and less chaotic environment for both buyers and sellers, reducing the stress often associated with real estate transactions.

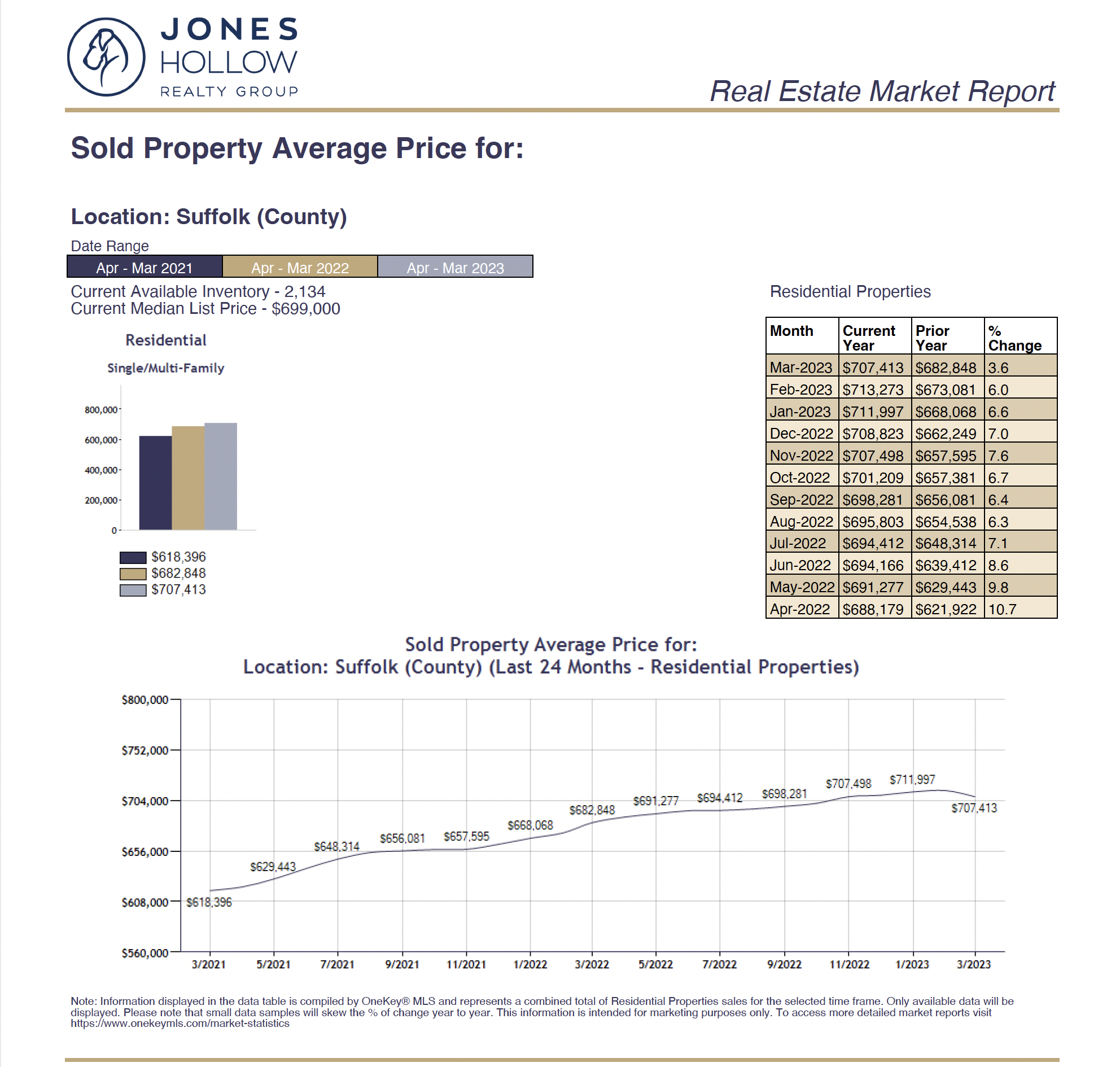

What’s the Average Suffolk County House Price in 2023?

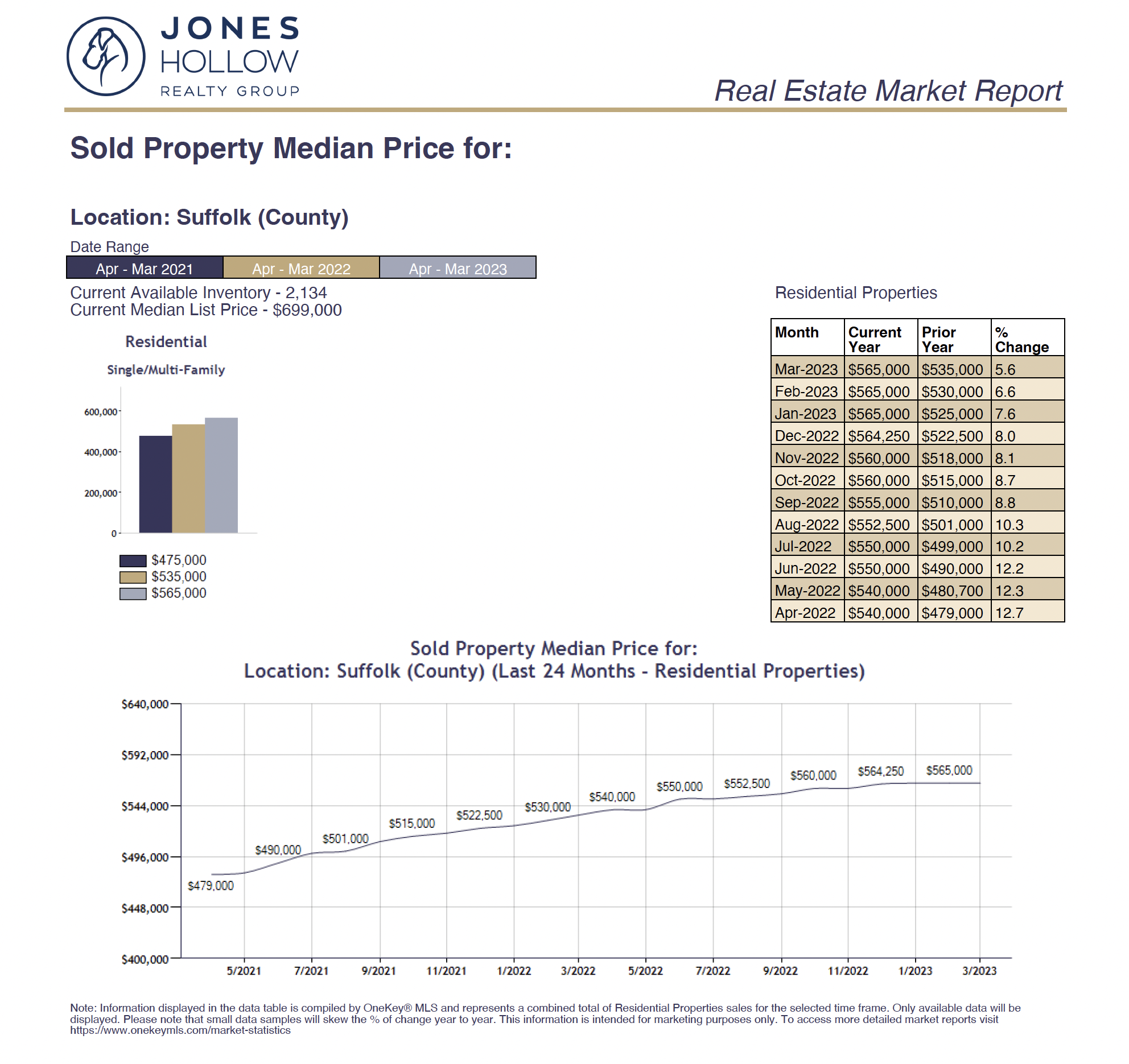

In March 2023, the average residential home price in Suffolk County was $707,413. However, experts typically focus on the median home price, which experienced a 5.6% annual increase, reaching $565,000.

It’s important to remember that the median price means half of all homes were listed above this price, while the other half were listed below. The median is generally a more reliable measure than the average, as it is less affected by a small number of extremely high or low-priced properties that can skew the average and make typical homes seem more or less costly than they truly are. As you monitor the average house price in Suffolk County in 2023, keep this distinction in mind.

Are We in a Housing Bubble?

The term “housing bubble” refers to a period where home values surge rapidly and then suddenly plummet. However, it appears that this scenario isn’t unfolding at the moment.

While home values did experience a surge after the onset of COVID-19, the growth rate began to taper off in mid-2022. From mid-2020 until 2022, there was a consistent rise in home values, with double-digit annual growth becoming the norm. However, we’re now seeing a return to single-digit annual growth, and there are no indications that home prices are going to crash. We believe that it’s more likely that the housing market will experience a cooling period, rather than a crash.

Market Factors to Keep an Eye On:

- Buyers Will Get Some Leverage: The housing market has shifted towards a buyer-friendlier market, which gives buyers more leverage, but sellers still hold some power. However, as mortgage rates increase and affordability decreases, sellers may need to adjust their expectations to match the changing market.

- Inventory Will Increase: Other areas of the country are also experiencing varying levels of inventory, with some regions reporting double the inventory of last year while others have seen a 25% decrease, according to Jones Hollow Realty Group. Despite fewer homes listed in the fall months, the market is expected to become more fluid as buyer activity picks up and more homes are expected to be listed once mortgage rates stabilize.

- Some Pandemic-Era Owners Might Face Buyer’s Remorse: Some homeowners who rushed to buy during the early stages of the COVID-19 pandemic may face buyer’s remorse in the coming years. Buyers may find themselves with no equity and a property they did not really want, forcing them to wait out the down market until the economy recovers.

- A Sense of Normalcy Should Return: The housing market is expected to return to a more normal pace in the coming year. Hardworking buyers will be able to purchase homes with their FHA loans, while sellers will experience a shift in power, which is a significant departure from the frenzied market of the past few years.

- Rates Will Continue to Rise: We Believe that mortgage rates will continue to slowly rise throughout 2023, reaching 8%. As rates go up, housing prices are expected to drop slightly, which could increase sales, but this is unlikely to alleviate inventory concerns. However, we are uncertain about when rates will decrease, but we believe they will likely hover between 6% and 8% for most of the year.

- Buyers Expected to Get Over Higher Mortgage Rates: Buyers will become more comfortable purchasing homes despite higher interest rates. People will realize current rates are still historically low compared to the average rate of 7% over the last 40 years, which may encourage renters to buy and convince sellers who were previously hesitant to list their homes.

- Buyers Will Be Choosier: Buyers will be more selective in their home purchases, as quality becomes a priority over inventory at high prices and they will take more time to consider their options and lean towards well-done homes.

Is Now a Good Time to Buy a House?

It’s important to remember that the state of the housing market shouldn’t be the sole determining factor in your decision to purchase a home. If you’re financially prepared and ready to make the commitment, then it’s a good time to buy a house, even if the inventory is limited. On the other hand, if you’re not ready, it’s not a good time to buy, even if there’s an abundance of houses available.

However, due to the current high demand for existing homes and low inventory, finding the perfect home may be challenging. If you’re prepared to buy a house, you may have to compromise some of your wants to obtain everything you need.

Should I Sell My House Now or Wait?

If you’re considering selling your home in 2023, the good news is that you can feel confident about doing so. While there aren’t as many buyers in the market as there were in 2021 when mortgage rates were at an all-time low, there are still plenty of people looking for a home.

If you’re truly ready to sell your house, consider putting it on the market sooner rather than later, while the inventory is still low. However, don’t let the market dictate your decision; it’s crucial to sell only when you’re ready.

Working with an experienced agent can help you take advantage of current home prices, navigate multiple offers, and find the right buyer. With an expert by your side, you’ll be able to sell your house at a great price this year.

How to Buy or Sell With Confidence in Any Housing Market

Buying or selling a home in today’s unpredictable housing market can be overwhelming. That’s why you need a trusted partner like the Jones Hollow Realty Group by your side.

Our team of experienced real estate agents has a reputation for providing exceptional service and navigating even the most challenging markets. We understand that every transaction is unique, which is why we provide personalized support to help you achieve your goals.

At Jones Hollow Realty Group, we pride ourselves on our commitment to excellence and helping our clients buy or sell with confidence. Choose us for expert guidance and a stress-free real estate experience, no matter the state of the market.

Download Full Report HERE:

1Q 2023 Review and Market Update

Brad Wilson, Broker – Jones Hollow Realty Group Inc.