Federal Reserve Chairman Jerome Powell testifies during the Senate Banking, Housing and Urban Affairs Committee hearing titled “The Semiannual Monetary Policy Report to the Congress,” in Dirksen Building on Thursday, March 7, 2024.

As you navigate the process of buying a home and securing a mortgage, it’s essential to understand how broader economic policies, like those set by the Federal Reserve, can impact your journey. The Federal Reserve, which plays a crucial role in setting interest rates, has hinted at potential changes that could influence mortgage rates in 2024.

Key Points:

- Interest Rate Cuts in 2024: The Federal Reserve members are predicting three interest rate cuts in 2024, despite a more positive outlook for economic growth. This means the cost of borrowing could decrease, potentially lowering mortgage rates.

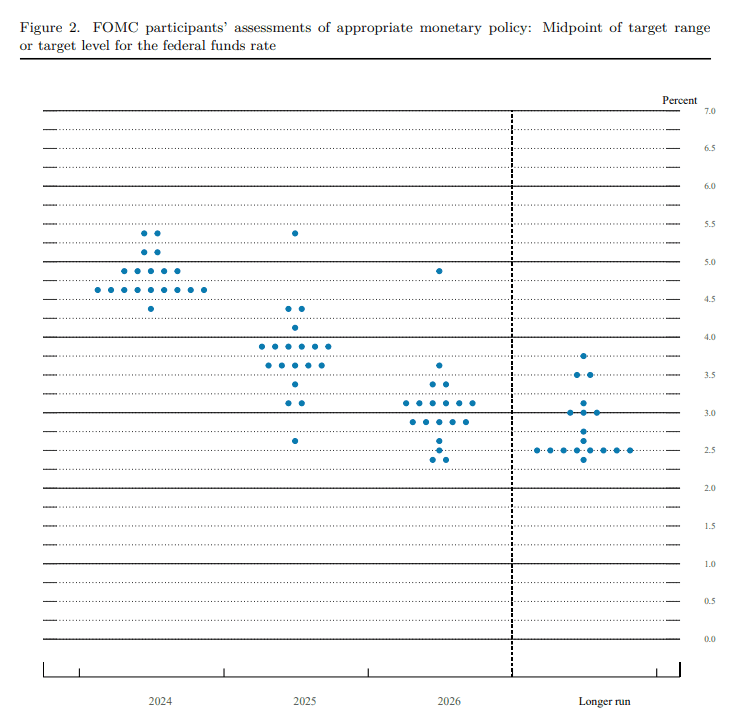

- Current vs. Future Rates: With the Federal funds rate currently between 5.25% and 5.50%, the anticipated cuts would reduce the rate to about 4.6% by 2024. This is based on a method of prediction known as the “dot plot.”

- Economic Projections: The Federal Reserve’s projections also show an increase in expected economic growth for 2024, from 1.4% to 2.1%. However, they anticipate a slight rise in core inflation. This mixed economic forecast suggests careful optimism but with an eye on inflation.

- Impact on Home Buyers: For potential homebuyers, this information is vital. If the Federal Reserve follows through with the anticipated rate cuts, mortgage rates could become more favorable, making it cheaper to borrow money to buy a home. This could be an opportune time to lock in a lower mortgage rate before rates rise again.

- What This Means for You: As a homebuyer, staying informed about these projections can help you make strategic decisions. Although mortgage rates are influenced by a variety of factors, understanding the Federal Reserve’s plans can provide valuable insights into potential trends.

Bottom Line:

The prospect of lower interest rates in 2024 offers a potentially favorable climate for homebuyers. At Jones Hollow Realty Group, we’re here to help you navigate these changes and find the best opportunities in your home buying journey. Keep an eye on economic developments, and let’s plan your next steps together.